VAT Credit/Debit Note

Are you registered with SARS for Value Added Tax (VAT)? If yes, then this information is for you.

You would have received an SMS from Vodacom about your VAT credit/debit note. In the previous month you used prepaid airtime to buy or subscribe to some of our content services (for example, Google, Apple and Microsoft). In line with a South African Revenue Services ruling, we are required to provide you with a VAT credit/debit note for some of these purchases.

- A VAT credit note is a document issued to update the assignment of VAT. It can be used by VAT-registered Prepaid or Hybrid (Top Up) customers to declare and pay the amount of VAT to SARS - within the applicable period to the extent that a VAT input was claimed on the relevant Prepaid Voucher. This is because the content services were bought with a prepaid voucher and the content provider’s invoice is the relevant VAT invoice document for this purchase

- A VAT debit note: this is a document issued to correct the assignment of VAT. It can be used by VAT-registered Prepaid and Hybrid (Top Up) customers to claim VAT - within the applicable period - if VAT was declared and paid on a VAT credit note if the content services were refunded.

A VAT credit/debit note ensures you are submitting an accurate VAT return and that you are not paying too much or too little for the Vodacom content services that you have purchased.

Note: You will not receive any money from Vodacom as part of this VAT credit/debit note, instead it should be submitted as part of your VAT return.

You will only see the detail of the Vodacom content services you bought which are applicable to the SARS requirement on the VAT credit/debit note.

If you are on an Airtime Hybrid package - such as RED Flexi - you'll be able to see the invoice number of the content services you bought, deducted from your monthly allocated airtime.

Any airtime discounts applied on your Airtime Hybrid account will also be shown on the VAT credit/debit note.

Follow the 4 quick steps below to request your VAT credit/debit note, this should only take a few minutes. Once you’ve done this, you can contact your tax advisor for more information on how to include this document as part of your VAT submission.

Are you registered with SARS for Value Added Tax (VAT)? Do you have a Hybrid/TOPUP Vodacom package? If yes, then please proceed.

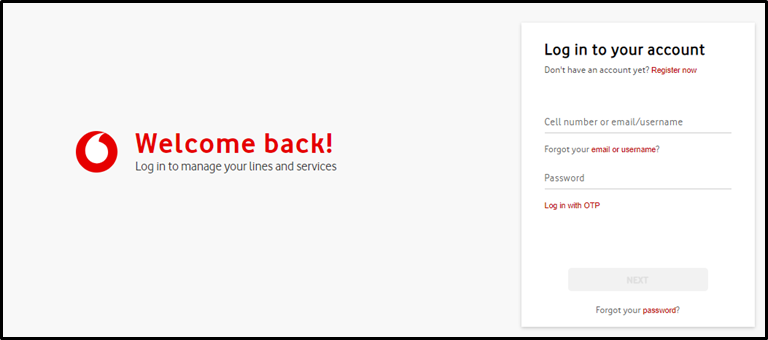

STEP 1

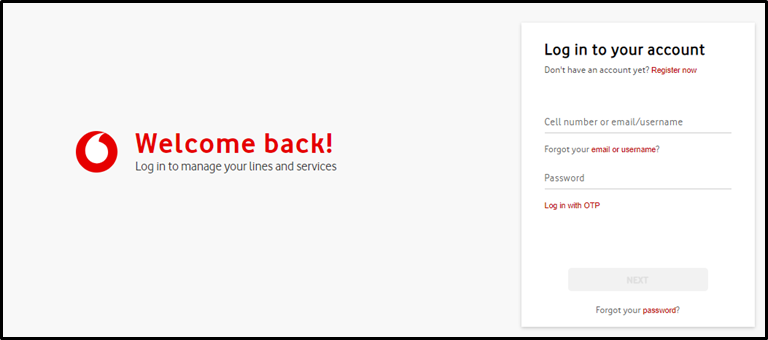

Log in to your account on the Vodacom Portal by clicking here. If you have not yet registered on the Vodacom Portal, you will need to first register an account.

STEP 2

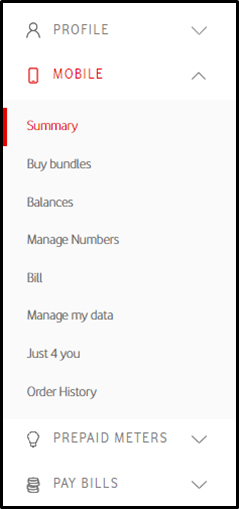

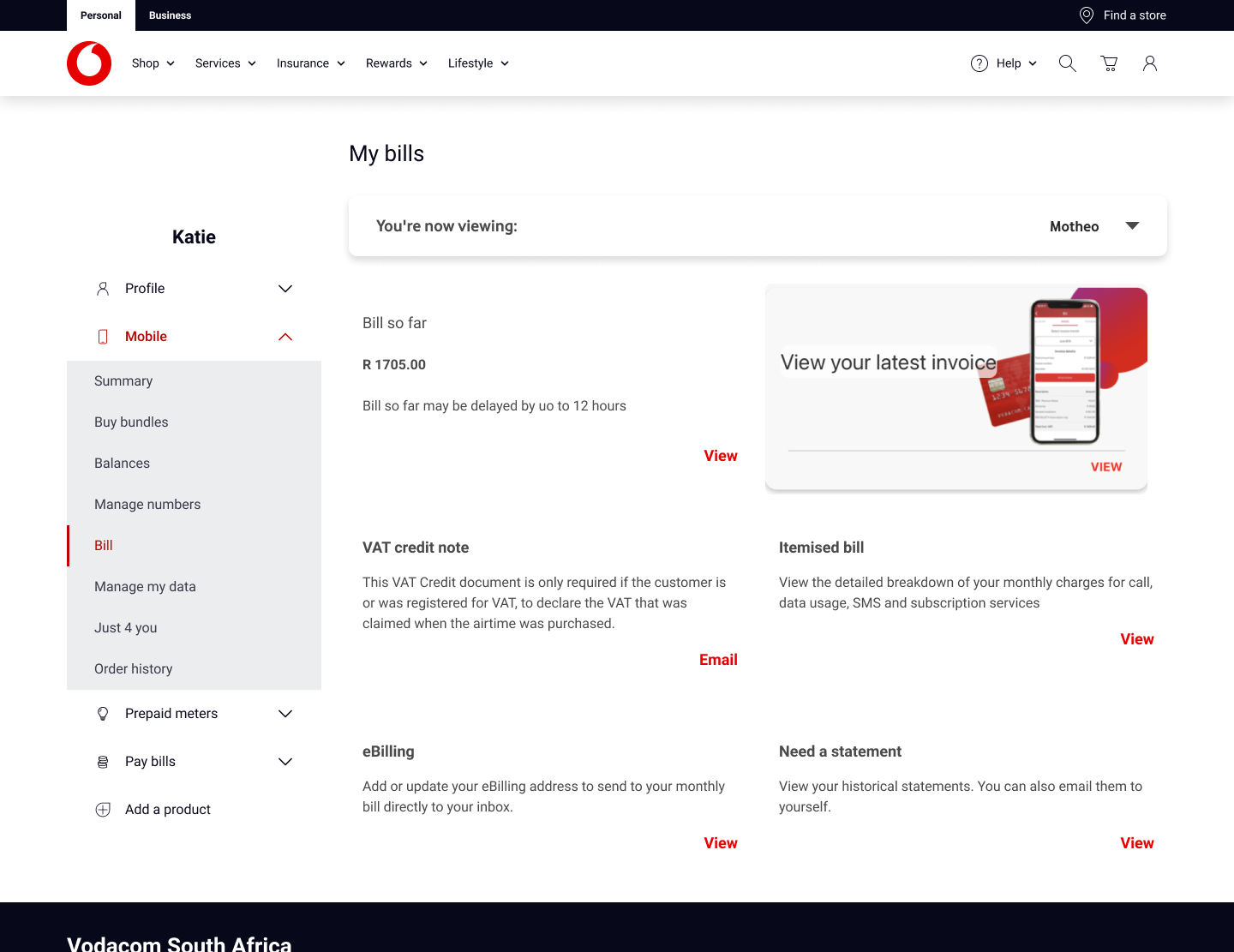

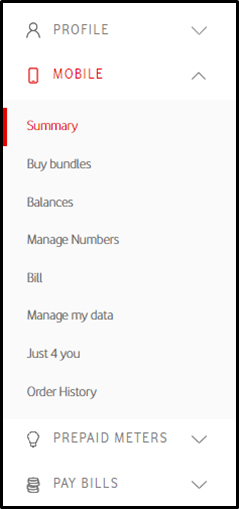

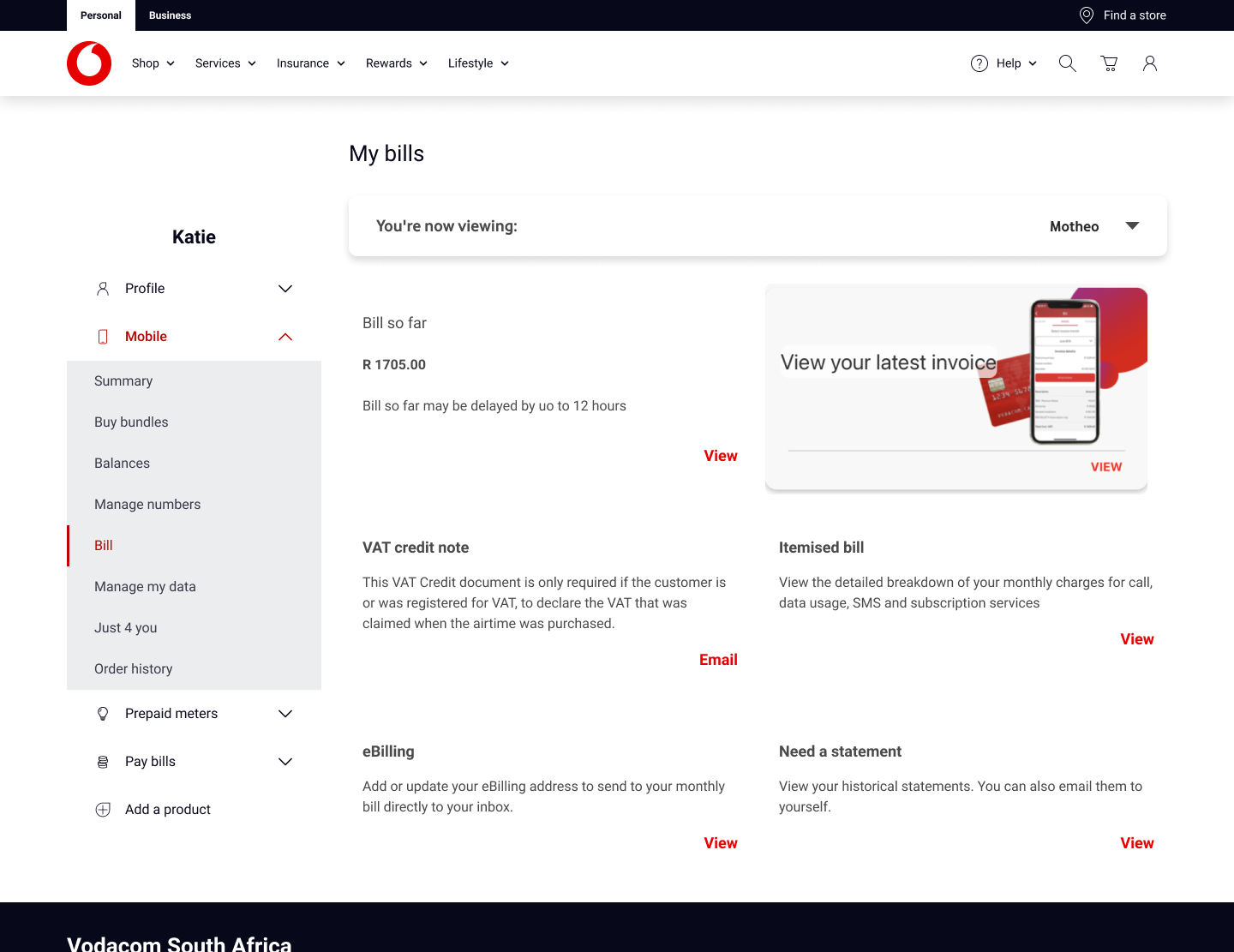

Once logged in, select 'Bill' from the navigation panel on the left.

STEP 3

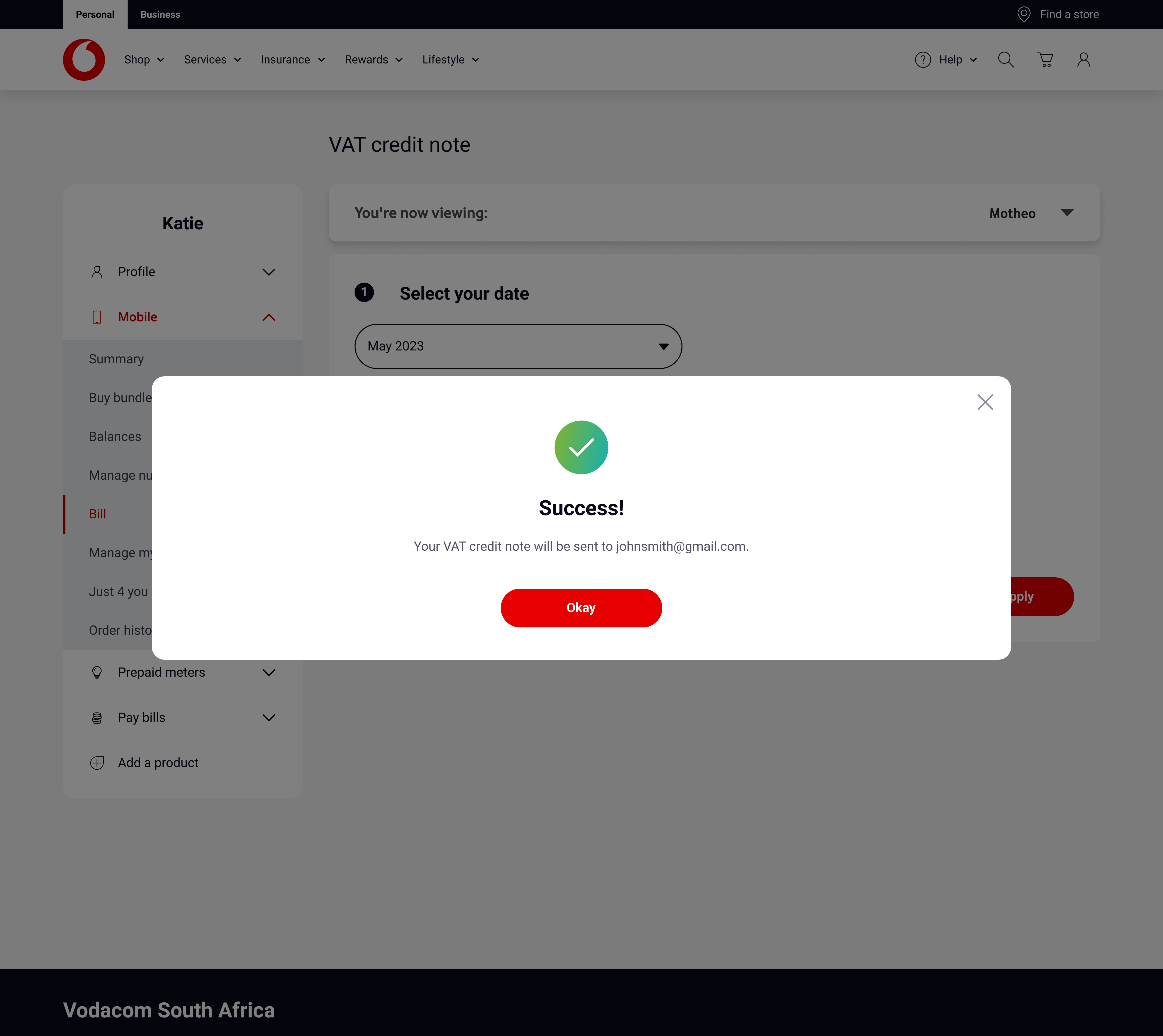

Select 'VAT credit note' from the panel which will then show you if you have a VAT credit/debit note available. If you do, click on 'Email'.

STEP 4

NOTE:

1. VAT Registered Hybrid/Top-up customer with a VAT Registration number on file with Vodacom to please note the following:

If you have provided Vodacom with your address and VAT Registration, these details will be displayed on your VAT Credit/Debit note.

If your address has changed you will have to contact Customer Care or visit a Vodacom store.

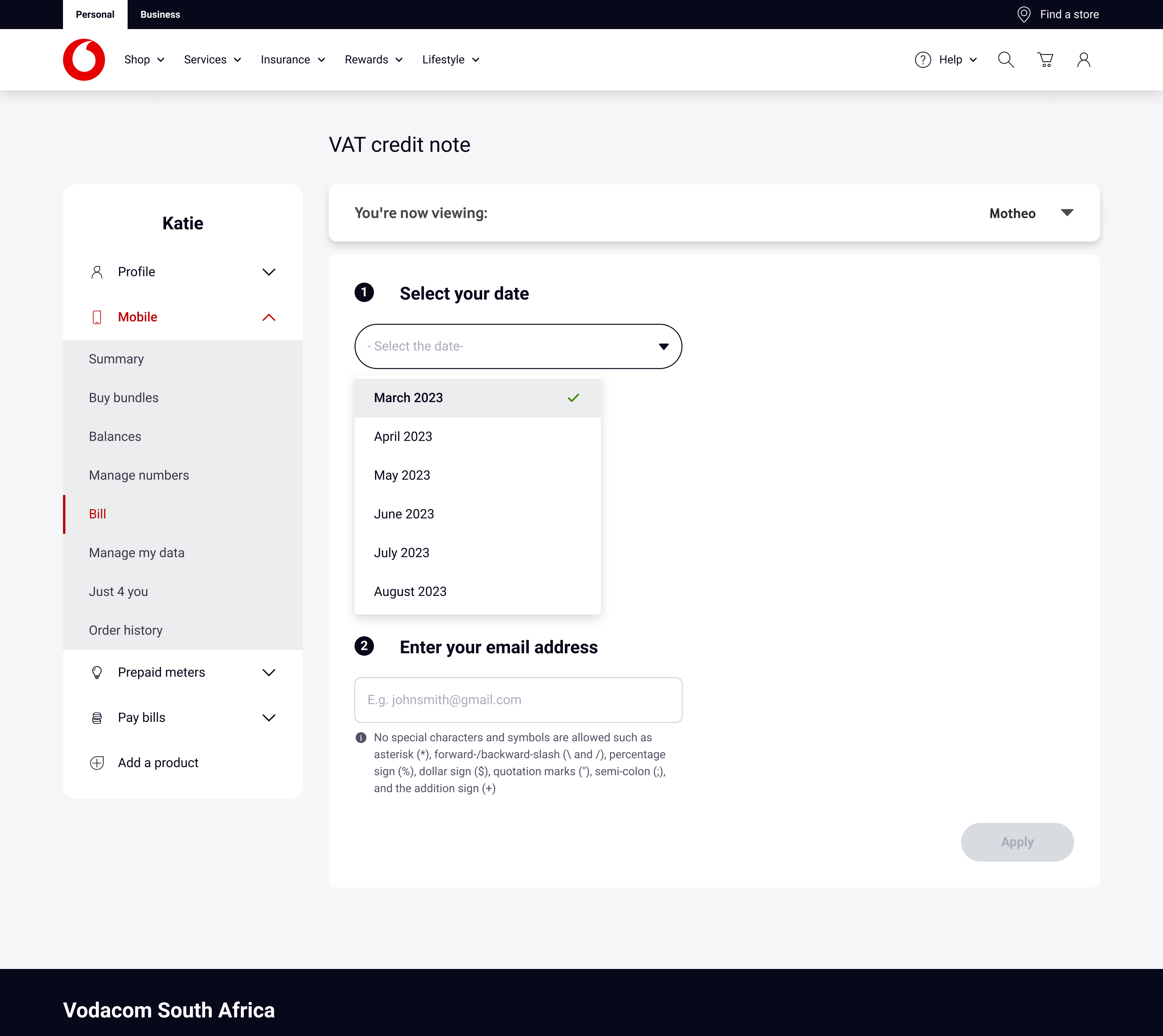

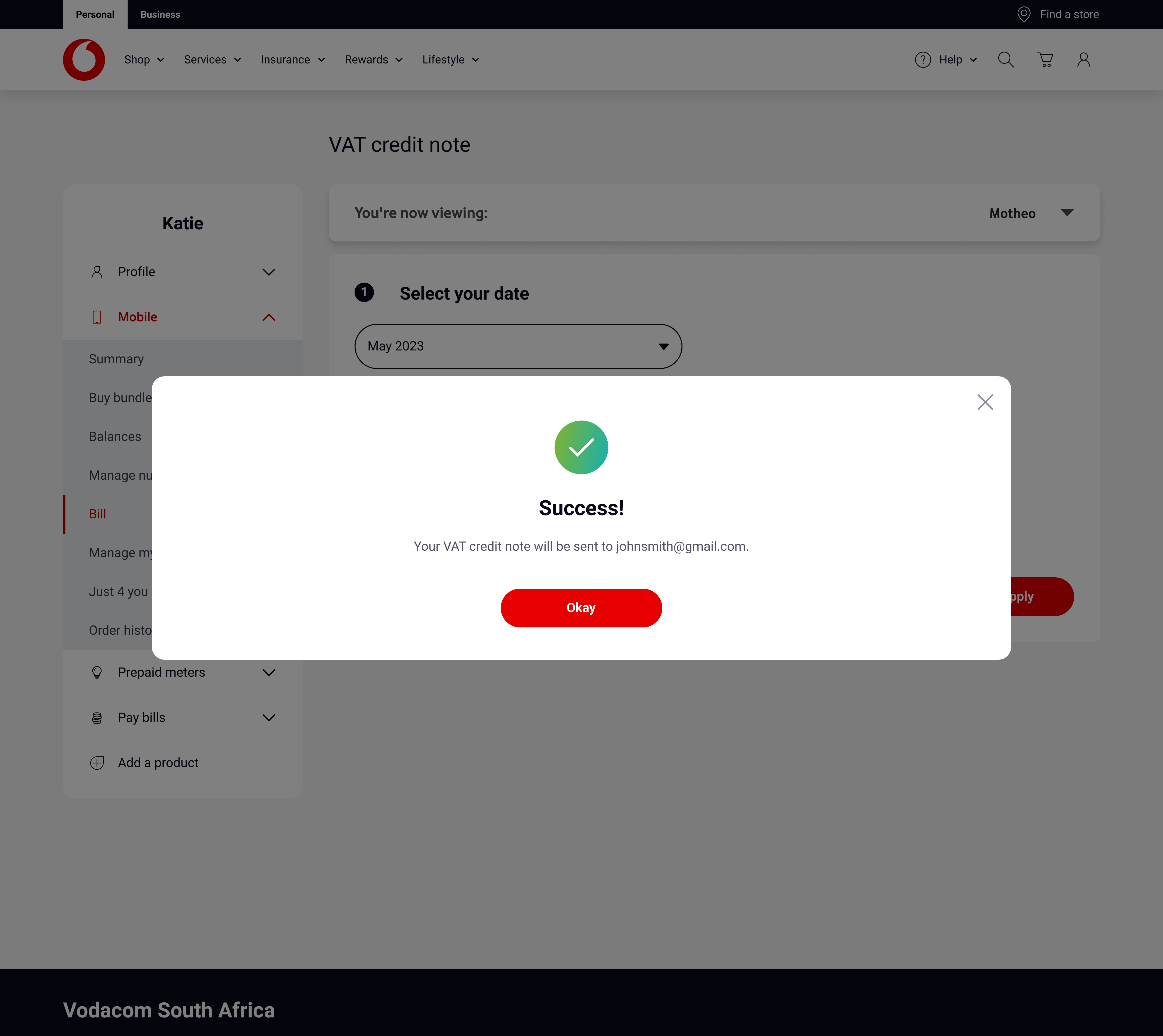

Next, select the date that you want the document for as well as the email address to receive the VAT credit/debit note. Then click 'Apply'.

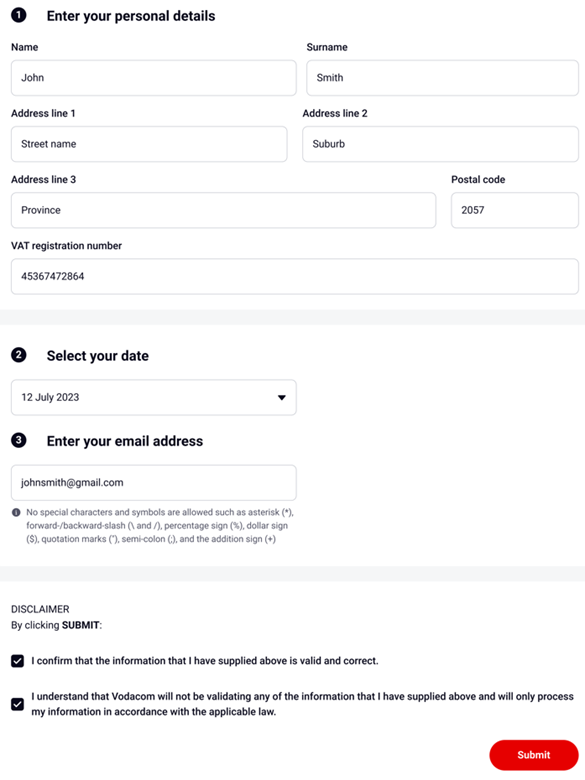

2. VAT Registered Hybrid/Top-up customer with no VAT Registration on file with Vodacom to please note the following:

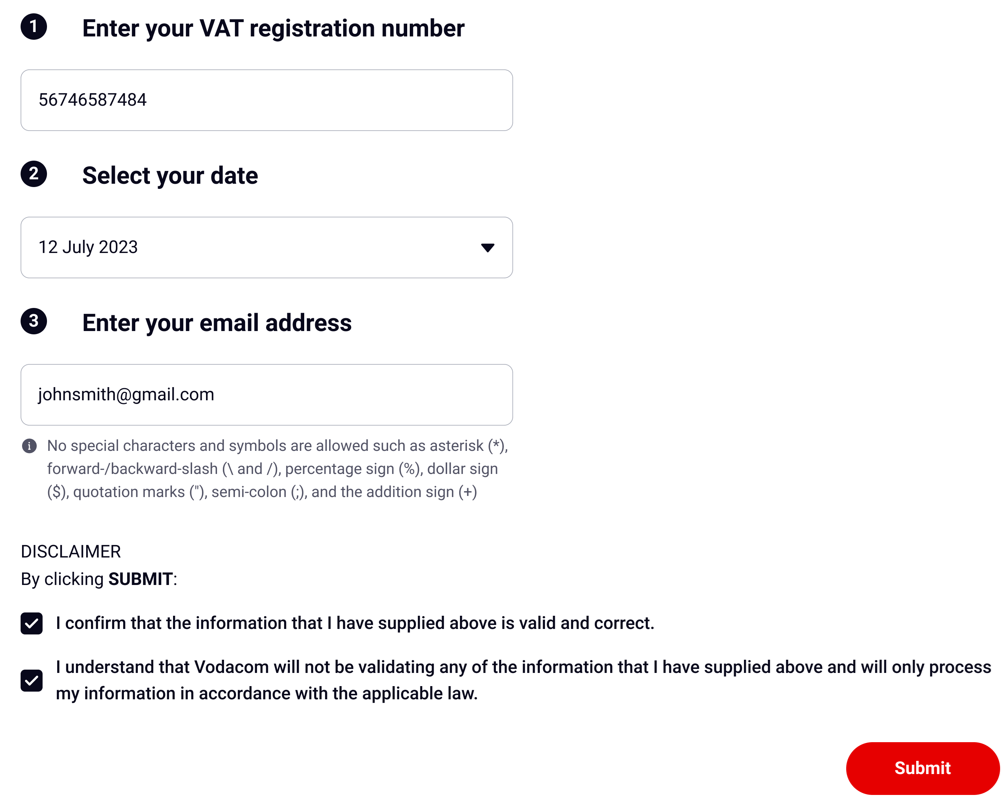

If you do not have a VAT Registration number on record with Vodacom, you will need to enter your VAT Registration number to be able to request a VAT Credit/Debit note. If you are not registered for VAT the VAT Credit/Debit note is not applicable to you.

Now, complete your VAT registration number and select the date that you want the document for. Next, input the email address and complete the disclamer. Click "submit" to receive the VAT credit/debit note.

Are you registered with SARS for Value Added Tax (VAT)? Do you have a prepaid Vodacom package? If yes, then please proceed.

STEP 1

Log in to your account on the Vodacom Portal by clicking here. If you have not yet registered on the Vodacom Portal, you will need to first register an account.

STEP 2

Once logged in, select 'Bill' from the navigation panel on the left.

STEP 3

Select 'VAT credit note' from the panel which will then show you if you have a VAT credit/debit note available. If you do, click on 'Email'.

STEP 4

Now, complete your Personal Details and VAT registration number on the form. Please note that Vodacom will not verify that the information you have provided is correct.

Select the month for which you require the VAT Credit/Debit Note

Enter the email address that you would like Vodacom to send the VAT Credit/Debit note to.

Complete the disclaimer. You will have to self-verify both fields before you can click on "submit".