Compare personal loans in minutes

Need extra cash, fast? Get tailored quotes on a personal loan, starting from R500 up to R350 000.

Compare quotes online in just a few minutes for different loan options from South Africa’s leading credit providers. Then simply choose the one that’s best for your needs and budget.

BENIFITS

Why choose VodaLend Compare?

GET STARTED

How to compare personal loans

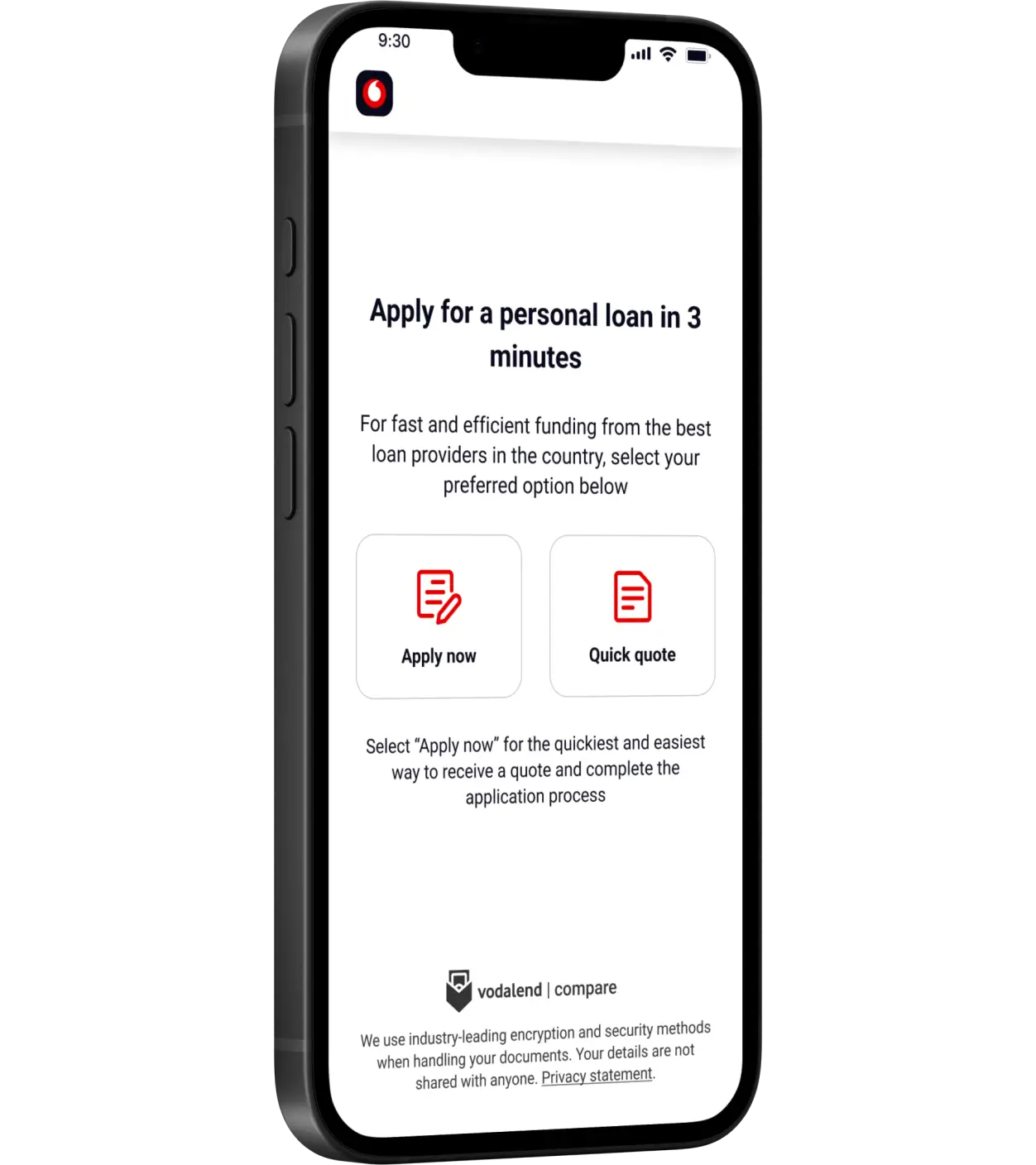

Apply online in under 3 minutes

Tap the button below to get started on your hassle-free, pressure-free quotes.

Fill in your details

Choose a loan amount and enter your personal details.

Accept the best loan offer

Choose the best loan offer from the options we find for you.

Money paid within 24 hours

Your loan will be paid into your bank account within 24 hours of your successful application.

LOAN BREAKDOWN

Example of a loan

Lethabo borrows R20 000 and chooses to repay it over 12 months:

- Initiation fee: R1 207.50 (once-off)

- Monthly service fee: R69

- Monthly credit life fee: R90

- Interest rate: 24% per year (calculated monthly)

Estimated monthly repayment: R2 110.39

Total repayable over 12 months: R25 460.65

*Interest rates are in line with the National Credit Act (NCA) and dependent on your risk profile. Repayment terms range from 3 to 72 months.

Everything you need to know...

What if I am Blacklisted or have bad credit?

Being blacklisted doesn’t necessarily prevent you from being able to access a loan. Some lenders do accept people with lower credit health and they typically get termed as blacklisted clients. It will just take a little more time to get access to credit. In most cases, you might need to look around for alternative lenders who are able to assist you.

What documents do I need for my application?

You might need:

- Your South African ID document

- Latest payslip

- 3 months most recent bank statements

Proof of residence

You won’t need any of this right now. We’ll source your bank statement data as part of the application process or you can upload them yourself. If you are approved and accept an offer from one of our partners, they might ask you to provide some of these documents.

How do I know which product is right for me?

Fortunately, our comparison engine is all about helping you make better financial decisions! The product offers you’re matched with are based on the details you provide. If these details are accurate and not falsified, you should have the right product offers in front of you.

It’s important for you to know what financial product you’re agreeing to. If you’re uncertain about anything related to this process, it’s important to read up and research the products and companies and make sure you understand how this process works.

Can I get a loan example?

Repayment terms range from 3 to 72 months. Interest is calculated monthly. A once-off initiation fee, monthly admin fees, and credit life insurance apply. Interest rates are in line with the National Credit Act (NCA) and dependent on your risk profile. Representative example: A loan of R20,000.00 over 12 months, calculated at an annual interest rate of 24%, results in total interest of R2,345.15. A once-off initiation fee of R1,207.50 applies, along with a monthly admin fee of R69.00 and a monthly credit life fee of R90.00. The total amount repayable is R25 460.65.

What is a credit-life fee?

Credit-life insurance is a type of cover linked to your personal loan that helps protect you and your family if something unexpected happens. If you pass away, become disabled, or lose your income, the insurance can step in to settle some or all of your loan.

In South Africa, credit-life cover is regulated by the National Credit Act (NCA), and the monthly premium is added to your loan repayment. The cost may differ depending on the loan provider and your personal risk profile.