COMPARE HOME LOANS

Get the keys to your new home

Ready to turn that “For Sale” sign into “Sold”? With one simple application, we help you find the best home loan offer across multiple banks.

FIND THE BEST HOME LOAN DEAL

Why use us?

START YOUR APPLICATION

How it works

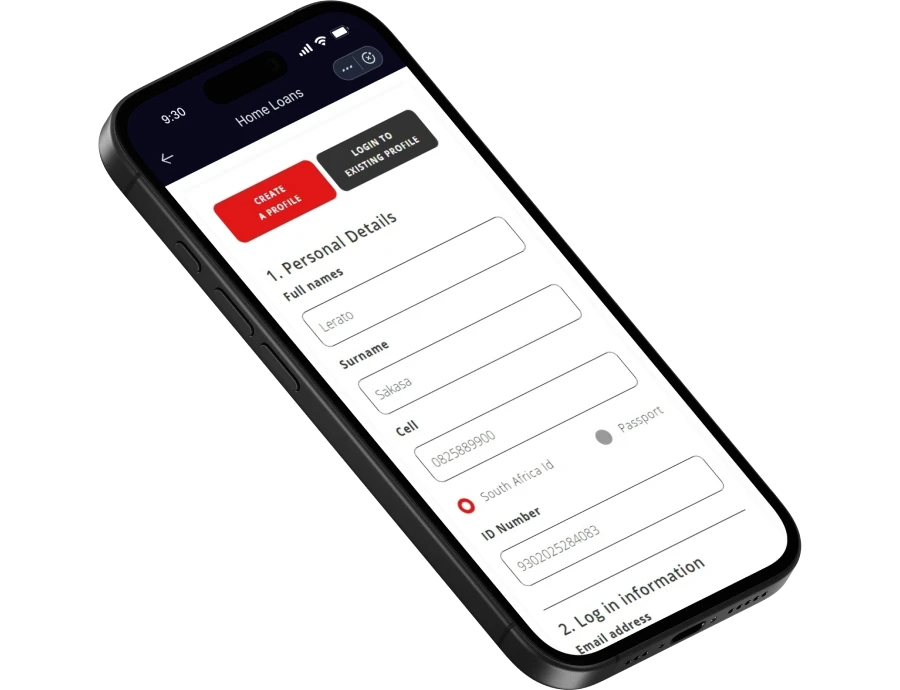

Create your profile

Complete a quick pre-approval check to see how much you qualify for.

Apply once, get multiple offers

Submit one simple application to compare deals from South Africa’s 7 top banks.

Choose your best deal

Review interest rates, fees, and terms side-by-side, and select the offer that suits you, we’ll guide you every step of the way.

Finalise your home loan

Your chosen bank will start the registration process — and you could qualify for up to R5 000 cash back once registered. Ts & Cs Apply.

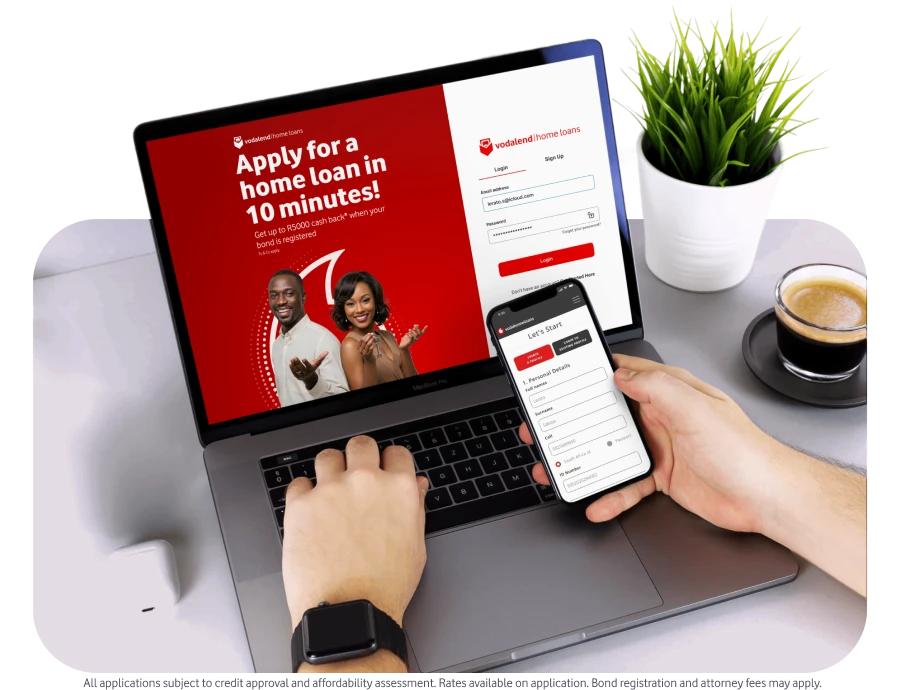

Home Loans Made Simple

VodaLend Home Loans makes it simple to find your best home loan deal- apply once, compare offers from 7 top banks, and check your affordability online through a free pre-approval. The platform is powered by MortgageMarket, South Africa’s largest and most trusted online home loan marketplace, renowned for delivering exceptional service and expert guidance to homebuyers.

Read our Ts & Cs here

Read our Privacy Statement here

Everything you need to know...

What do I need to do to get my home loan?

- Once you’ve signed an Offer to Purchase and have electronic copies of your ID, latest payslip and 3 months bank statements, then you’re ready to complete the online home loan application.

- You’ll first be required to create a profile and then you’ll continue to complete your application form online.

- As your application is submitted in real time to the top banks, you will start to receive offers from the banks within 72 hours. We will provide you with regular feedback from the banks.

Once offers start coming in, you’ll be able to compare them on your dashboard and once you’ve selected the best offer for you, the bank will be notified and will be in contact with you to finalise your home loan.

How long does the application process take?

How long does the application process take?

- If you have all your documents on hand, the application process could take less than 30 minutes to complete.

- You can save your application form at any point in the process and complete it at your convenience.

- Once you’ve submitted your application, compared and selected an offer from the banks, they will be in touch to finalise the home loan process.

- This process could take up to two months to complete.

How do I know how much I qualify for?

Use our free pre-approval tool to find out your affordability and credit score.

What is my affordability based on?

Your affordability is based on your income and level of debt against your income. The debt service ratio ideally shouldn’t be more than 30% of your gross monthly income, whether single or joint. Banks are guided by the rules set out by the NCA (National Credit Act of South Africa), which helps to protect South Africans from getting into too much debt.

What do banks look at when they review your home loan applications?

- Banks consider your relationship history with past and current creditors. Your ability to make consistent repayments to your creditors is a critical factor in the credit assessment process.

- The second factor banks will take into consideration is your affordability, i.e. your monthly income minus your fixed expenses. This gives you a surplus that makes up a budget for what you can afford to spend on a house.

- They also take into consideration the deposit amount you have available, which gives them a level of your equity commitment in the property.

What costs do I need to be aware of?

There are a few once-off costs that you will need to budget for, such as transfer costs, transfer duties, initiation fees and bond registration costs. These costs are in addition to your monthly home loan repayment. Use our transfer cost calculator to better understand these once-off costs.

What are transfer costs?

- The transfer cost is the cost to have the property transferred into your name at the Deeds Office. This cost consists of a once-off fee that you will pay to the government in terms of the transfer duty (any property below the cost of R1.2 million is exempt from transfer duty).

- The other cost is the fee to register your property, the conveyancing attorney will charge this fee. This money will be used by the attorney to register you as the owner of the property at the Deeds Office.

What are transfer duties?

The cost you pay for transfer duties is calculated based on the price paid for the property. This duty is a government tax. Use the transfer cost calculator to better understand how much you would need to pay, based on the property that you’ll be purchasing.

Why do I have to pay bond registration costs?

The registration cost is a fee that the registering attorney charges in order to register the property in your name at the Deeds Office.

What other costs should I be aware of when applying for a home loan?

- Besides the upfront costs such as the transfer duty, bond registration and bank initiation fees, you will need to consider maintenance costs, such as the rates and taxes, levies (sectional title property) and the cost of insurance such as homeowner’s cover.

- The banks require you to have insurance cover on the property, as this is highly beneficial to managing the risk of damage to the asset.

Is it possible to pay off my home loan earlier than the loan term?

Yes, it is. You can use the extra payments calculator to help you understand how much you will save when you choose to pay more than the minimum amount required on your home loan.

What should I look at when comparing home loans?

There are three main points to look at when comparing home loan offers, namely:

- Interest rate: The lower the interest rate, the lower your repayment.

- LTV (loan to value): The higher the LTV, the less deposit will be required, if any.

Loan term: The number of years required to pay back the home loan.

Example: If your loan term is over a shorter duration, then less interest is payable, but higher monthly instalments will be required. If a longer repayment period is selected, the more interest is payable, but your home loan instalments will be lower.

What will my monthly home loan instalment include?

Your monthly instalment usually consists of:

- Basic instalment that includes capital and interest.

- Homeowner’s insurance premium.

- Life assurance premium (if selected).

- Admin fee.

Why wouldn’t I qualify for a 100% bond?

There are various reasons that could affect your ability to qualify for a 100% home loan, such as your affordability, your credit history or even the value of the property that you’re wanting to buy.

Why should I save for a deposit?

We recommend that you start to save for a deposit the day you decide that you want to buy a house. The bigger the deposit you manage to save, the smaller the home loan amount you will require. By saving up for a deposit, it will improve your chances of being approved for a home loan, as well as reduce your monthly repayments.

How does the up to R5000 cash back work?

The main applicant may qualify for a cashback straight into their bank account. Ts & Cs Apply